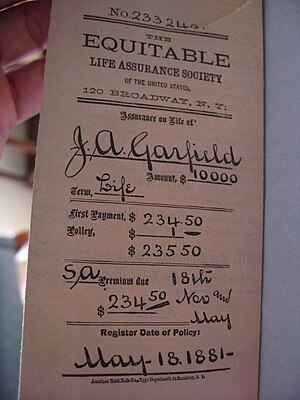

Image via Wikipedia

Image via WikipediaFinancial IQ Philippines Quick Hit(s):

While you are still healthy and insurable, plan to get a life insurance policy. The lower premium cost is a bonus.

Why do I need to get life insurance when I am still young?—Young Urban Professional

Here’s the typical script of a yuppie, whether from Gen X or Y, to an insurance agent when offered a life insurance policy. “I am young. I just started earning serious money. And here you are talking to me about death? With what I am earning now, it will take me just a few years to build up enough savings to match the coverage that your life insurance policy is promising. Plus, I have grand plans and your life insurance premium will just be an expense that will slow me down.”

For some reason, I can hear Richard Harris playing his favorite character of an old leader full of wisdom and experience, whether as Albus Dumbledore in the earlier Harry Potter movies or as Marcus Aurelius in Gladiator, and reacting to the above script with the line, “Ah, the folly of youth!”

I was once, and still prefer to think of myself as a yuppie. Alas, my age shows for even the use of the word yuppie is not in vogue anymore. Nevertheless, it is said that experience is the best teacher. So let me relate my experience as far as life insurance goes.

http://business.inquirer.net/4255/life-insurance-in-my-30s-too-early

No comments:

Post a Comment