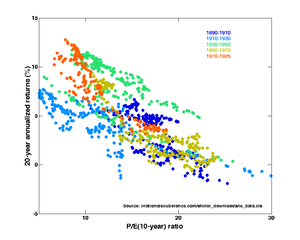

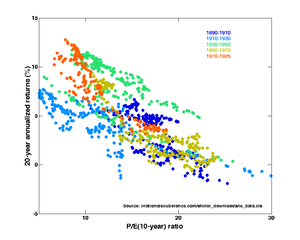

Price-Earnings ratios as a predictor of twenty-year returns. From Irrational Exuberance, 2d ed. source (Photo credit: Wikipedia)

Price-Earnings ratios as a predictor of twenty-year returns. From Irrational Exuberance, 2d ed. source (Photo credit: Wikipedia)

Financial

IQ Philippines

Quick Hit(s):

Here is a take from one of the industry leaders, Henry Ong, on selling stocks. This is one of the ways a number of traders take profit, by assessing if the

stock price is over valued. Then they will sell and buy those back again when the price drops.

Q: The stock market has been doing well lately with the PSE index hitting record high at 5,300. I have bought some stocks last year and I don’t know if I should sell now to take profit or wait for the stock to go up further. Can you advise me?—A.K. Apostol by e-mail

A: In a market like this where everyone is optimistic about stocks, it is difficult to decide to sell especially if the stocks you are holding are performing well. When the market is bullish, you will seldom hear your broker advising you to sell. This is because your broker may own some stocks himself and he wants to sell first before you do. Or maybe your broker doesn’t want to disappoint the insiders of the stock who are its clients also.

Whatever it is, recommending a “sell” creates less business for the broker because a sell advice is only for clients who already own the stock while a buy advice is for everyone.

When brokers do not want to say that a stock is a “buy” and, at the same time, hesitant to call it a “sell,” they usually recommend a “hold,” meaning do not take any action on the stock. You should consider a “hold” a danger sign that something is wrong with the stock and, therefore, you should investigate further to validate your doubts. You can ask your broker about their honest opinion on the stock or you can read the explanation in the research report. If the tone of the report or the way they explain to you sound less exciting, then this is sign for you to cash out.

If your stock is doing well and there is a strong uptrend momentum, you may consider selling a portion of your stocks. For example, you can lock in your profits by selling one-third of your holdings as stock price rises. Do not attempt to sell all your shares at the top because you may never catch it. You can unload your stocks slowly each time at higher price level until you have completely sold out your holdings. Why do we do this? As stock price goes up, the probability of it declining also increases. You do not want to chase selling down your stocks when stock price is falling sharply. By that time, you may already be in panic and selling on fear. Sell while it feels good. Maximize your selling price by getting the highest average instead of catching it at the top.

But at how much should you sell your stock? If your stock is overvalued, it is time for you to consider selling because sooner or later, the market is going to come up on it. You can determine the value of the stock by looking at its P/E ratio. As a rule, a stock is considered expensive if its P/E ratio is comparatively higher than the market average. But there are some stocks that command premiums, say SM Prime Holdings or Ayala Land, because of their strong management and market presence. In this case, these stocks may be considered expensive if their premiums are way beyond historical average.

Assess the current valuation of your stocks. Which stocks are already ripe for selling? Which ones still have potential to go up? Do your own research by checking the latest corporate disclosures. Are there any developments that may cause a slowdown in their earnings? Do quarterly earnings results meet market expectations? Try to project your own earnings estimate and P/E ratio based on your findings and calculate your target selling price. This may not necessarily be the price at which you need to sell all your stocks, but will simply serve as your guide in decision making.

Always look for opportunities to sell. You can sell on good news, for example. You can take advantage of the market excitement from a particular positive news announcement by selling on strength. There are two kinds of news that you should watch out for. One is the ordinary good news, for example, results of higher-than-expected earnings, or declaration of stock dividends. These are news that boost stock prices temporarily. You can sell at good price and buy back later when it falls back after correction. The other kind of news is the major news, the type that brings permanent development to the company. For example, news about discovery of additional gold reserves or acquisition of a competing company.

The initial reaction may be similar to the ordinary good news, but it may not correct so much because this may invite fresh demand from investors that may carry the stock price at higher level. In this case, control your selling as new earning prospects could have changed your valuation.

Planning to sell involves preparation. Develop a mind-set for profitable selling. It is normal to commit selling mistakes sometimes but never forget to learn from it every time you fail. Try to be objective and less emotional as much as possible when it comes to selling.

http://business.inquirer.net/58129/when-is-the-best-time-to-sell-a-stock

English: Floor proceedings of the U.S. Senate, in session during the impeachment trial of Bill Clinton. (Photo credit: Wikipedia)

English: Floor proceedings of the U.S. Senate, in session during the impeachment trial of Bill Clinton. (Photo credit: Wikipedia)