Image via Wikipedia

Image via WikipediaFinancial IQ Philippines Quick Hit(s):

Yes, Pacquiao is insurable.

Can Pacquiao be insured? Can an unmarried couple jointly buy property & life insurance?

My boyfriend is a big fan of Manny Pacquiao and I’m just curious if big firms like Insular Life insure athletes like Pacquiao who are into violent sports like boxing. I’ve read of boxers dying in other countries. Another question: My boyfriend and I plan to jointly buy a house with our savings plus some money from our parents, but we are not yet married. Can we legally buy and jointly own property, and can we also buy life insurance with each other as beneficiary though we are not yet married?

Karla B. Villagracia, 25 years old, housewife, General Santos City, South Cotabato

Answer 1

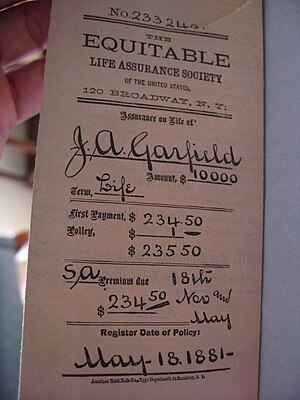

Athletes are generally acceptable for life insurance but are usually not allowed disability cover. Even athletes who are engaged in aggressive, violent sports involving physical contact like Manny Pacquiao, who is a professional boxer, may be covered for life insurance. However, premiums will be higher to reflect the higher mortality risks, not only during his professional career, but even in later years due to brain damage.

Answer 2

Buying a property prior to your marriage from your respective savings may be legally done. Your relationship under such an arrangement shall be governed by the provisions of our Civil Code on co-ownership. With respect to life insurance, either of you may secure life insurance on your respective lives. Based on our Insurance Code, you as insured/owner may designate any beneficiaries to your life insurance policy, provided that they are not disqualified by law. Those disqualified by law are those persons who are prohibited by law from receiving donations from the insured, as provided under Article 739 of the Civil Code of the Philippines. However, such beneficiary designations may be subject to the internal rules and regulations of insurance companies in accordance with their respective underwriting policies. It may also be worth considering that the designation of the beneficiary be initially made as “revocable” to provide the insured/owner with the necessary flexibility in adding or changing beneficiary/ies, just in case he/she deems it necessary or proper. Anyway, the revocable designation can be made irrevocable in the future at the discretion of the insured/owner. The choice of revocable or irrevocable beneficiary designation is important in determining the estate tax implications of the insurance proceeds. We suggest that a professional life insurance agent or financial advisor be consulted on this and other life insurance matters for proper guidance.