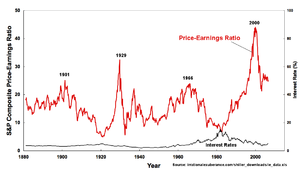

Plot of S&P Composite Real Price-Earnings Ratio and Interest Rates using data from irrationalexuberance.com/shiller_downloads/ie_data.xls (Photo credit: Wikipedia)

Plot of S&P Composite Real Price-Earnings Ratio and Interest Rates using data from irrationalexuberance.com/shiller_downloads/ie_data.xls (Photo credit: Wikipedia)Financial IQ Philippines Quick Hit(s):

Here is an insight from one of the industry leaders on the financial market. As long-term investor, it is always a good opportunity to buy good stocks at discounted prices.

Question: The market seems to be trending nowhere these days. There are days when the market is up but the trend never seems to last. Once it goes down, it stops at its previous low and it goes up again. It has been like this for weeks. I am confused and I don’t know if this is the best time to sell or buy. Can you advise me?–KC Almajose by e-mail

Answer: Yes, it is not easy to trade when the market is nontrending because the uncertainties will simply limit your opportunities to profit. Sideways market occurs when the market trades within a narrow range without any clear direction. This is a natural market behavior when traders and investors prefer to wait and see after a significant sell-off. The PSE index has fallen by as much as 9 percent from an all-time high of 5,329 to a low of 4,864 recently. It has since then slowly recovered and drifted sideways to date. You will notice that the average volume traded has also decreased indicating lack of market interest.

But this is temporary. Normally, when sideways market occurs, players are anticipating a breakout of the trading range either upward or downward. If the market is expected to prolong its sideways movement, it is very likely it will eventually break down because investors will get impatient and sell their stocks to raise money for investment somewhere else. This only happens when the opportunity cost of investing outside the stock market is higher.

Our current economic backdrop tells otherwise. Interest rates are falling. Inflation rate is declining to historical lows. Our credit rating is expected to get an upgrade soon. There is every reason to expect that the market will soon end its consolidation phase and resume its uptrend. Although the market is moving sideways, the PSE index over the past few weeks has been trending slowly on higher lows, which means there is a significant bargain hunting activity taking place whenever the stock prices fall at attractive levels.

This is a good opportunity for you to come in and accumulate stocks that you expect to perform well when the market returns to bullish mode. The first stocks that you should look for are those that compose the PSE index because they are the first ones that will move strongly. These are the so-called blue chips because of the size of their market capitalization and industry representation. However, not all are profitable and, therefore, not all have reliable valuations.

Start by reviewing the line-up and select the stocks that will be part of your portfolio. You can choose PLDT and Meralco as your core holdings. PLDT is a good buy because it is trading at prospective P/E ratio of only 14x earnings, cheaper than market average P/E of 17x. Immediate target should be somewhere between P2,600 and P2,700 from the current level. Meralco may be at par with market P/E but, historically, it is a favorite of foreign fund managers. Its current price offers good entry level as it is 18 percent off its 52-week high.

Another stock that you can consider is Megaworld. It is relatively cheaper compared to the other stocks in the PSE index, which are trading way above average. Megaworld’s P/E ratio is only 8x, which is about half the market average P/E ratio. Historically, this stock is highly volatile so there is no hurry to buy it at current prices. You can accumulate it when it trades at lower range. This is one stock that will outperform strongly when the market returns to bullish mode.

The other stocks in the PSE index are relatively expensive because they are either at par or higher than market average. Of course, it doesn’t mean that their stock prices will fall or that they are not good. It simply means they are relatively expensive and further upside may be limited as compared to stocks with lower valuations.

There are equally good stocks with promising fundamentals and which offer attractive P/E valuations that are not part of the PSE index. You can research on them for inclusion in your portfolio.

Once you have selected your stocks, you can accumulate slowly. One way to accumulate is to buy stocks regularly for a fixed specified amount regardless of number of shares bought. It can be weekly or monthly. For example, you commit to invest P25,000 monthly and you selected Meralco. If Meralco is trading at 241 today, you can buy 103 shares for a start. If in the following month, Meralco’s stock price falls to 235, using the same fixed investment of P25,000, you can buy more with 106 shares. You buy more shares when the stock price goes down and buy fewer shares when the price goes up. You will be able to lower your average buying price that can beat the market in due time.

The current sideways market is a good opportunity to position for the next market run-up. The positive economic forecast for the year should be validated by the results of second-quarter earnings next month. Watch out for revaluation as some companies may release above expected earnings results. Monitor their corporate disclosures about new projects and expansion, and analyze how these will impact their earnings. The higher the expected earnings, the cheaper the valuation and therefore more upside potential in the stock price.

After the second-quarter earnings results in the next two months, some stocks will be revalued and it is possible many stocks that were previously expensive may become cheaper.

No comments:

Post a Comment