Image via Wikipedia

Image via WikipediaFinancial IQ Philippines Quick Hit(s):

Could not agree more with this article. We need to find ways to make money from cash and to outpace inflation. One way is to invest a portion of your money in financial instruments (like securities, mutual funds, etc).

(This is part of Take Charge of Your Money , a partnership between INQUIRER.net and Citibank to help readers handle their personal finances well.)

Question: Thanks to all the money advice I see on TV and read about in the papers these days, I’ve decided to build up my savings and invest them this year. I’m conservative, though. I don’t think I can participate in risky investments. Would putting my money in time deposits be good for me? — Giselle

Answer: It’s good that you have decided to build up your savings and go into investments this year. We all need to take responsibility for our financial future and part of this means growing our money wisely. This can be achieved with diligent saving and with the proper investments.

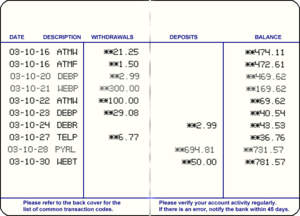

Cash placed in bank deposits (whether savings, current, or time deposit accounts) is good to have since you will be assured of having a readily available fund for contingencies. In fact, everyone should have a bank account (savings account at least) which can be a good tool in putting away money for future needs and goals.

Holding large amounts of cash in the bank, however, is not a wise idea, and neither is putting all your money in bank deposits. According to the book The Citibank Guide to Building Personal Wealth, “Given the expanded investment opportunities in the region, holding very large deposits of cash is a misapplication of resources. Whether interest rates are high or low, cash does not produce a good return compared with other investments.”

For instance, let’s say you invested $100,000 in global equities in 1989 to prepare for your retirement. The following year, market prices go down by about 16 percent. You have three choices:

Option A: revert to cash (put all that money in bank deposits);

Option B: stay invested (keep the money there in global equities); and

Option C: invest more (add another $25,000 for instance).

In 2009, the year of your retirement, these may be the results of the action you've taken:

With Option A: If you withdrew your money in 1990 and put them in bank deposits, you would have the lowest returns among the three options.

With Option B: If you stayed invested all these 20 years, you would have more than doubled the investment.

With Option C: If you invested more, you would have almost tripled your investment.

In this illustration, you can see why cash isn’t king all the time, especially when it comes to investments. Investing in bonds and equities, whether by straight direct investments or via pooled funds such as mutual funds and unit investment trust funds, may potentially earn more income without you doing anything.

This is not to say though that you should put all your money in bonds and equities. These investments carry a certain amount of risk — higher in fact, in the case of stocks or equities. You may earn, but you may also lose your capital.

And that is why allocating your investible assets should be given much thought. One should have a mix of investments for the short term (cash deposits would be good for this) and the long term (suitable for bonds and equities). You may also invest in other forms of assets such as real estate, fine art, jewelry, or a business, but again, don’t put all your money in any one asset class to spread the risk of incurring losses.

Just how much should you keep in cash? The book The Citibank Guide to Building Personal Wealth tackles this question: “We all need to have some cash available at all times, but the proportion of your wealth that you should keep in cash depends on your individual circumstances and attitudes.” The book suggests two ways to determine how much cash to keep in the bank:

1. Keep enough cash to pay for all your normal expenses for a given period of time, like three months to a year, and add a lump sum for emergencies.

2. Set aside a certain percentage of your total assets in cash. “If you keep more than 10 percent of your wealth in cash, it is worth taking another look to see if you really need to hold such a large sum,” the same book says.

Allot the rest of your money pot according to your appetite for risk, investment goals, and time horizon for investing. If you are young and still have a lot of years to work ahead of you, consider investing more in bonds and a little in equities, especially if you are conservative like you said. Bonds give a steady rate of return over a number of years. If you are young and don’t mind taking risks to potentially earn more, you may want to put more money in an equity fund rather than in a bond fund. Equities may go all the way up during a market bull run.

Just because your money is not all in cash deposits does not mean you cannot have access to it in times of emergency. Your participation (units or shares) in mutual funds or UITFs, and even your direct stock or bond investments can be converted to cash quickly. However, to maximize their earning potential, hold them for the long term as much as possible.

February 24, 2009

No comments:

Post a Comment